Northrop Grumman Company Profile

Northrop Grumman (NYSE:NOC) is an American defense technology and aerospace company that is based out of Virginia. The companyís roots can be traced back to when the Northrop and Grumman Corporations were created in 1939 and 1930 respectively. The actual merger between the two companies did not take place until 1994. Today, Northrop Grumman is a weapons and defense giant with a market capitalization of roughly $75 billion and was the 101st largest company on 2022ís Forbes Fortune 500 list. In terms of operations, Northrop Grumman operates in every imaginable segment of defense and military. These include air, space, cyber, land, sea, multi-domain, and advanced weapons. Although its primary client is the United States, it also has global operations in focus countries like Japan, Australia, South Korea, and the Middle East. Northrop Grumman manufactures some of the most cutting edge military vehicles in the world including the B-2 Spirit Stealth Bomber and the E-2D Advanced Hawkeye

In terms of operations, Northrop Grumman operates in every imaginable segment of defense and military. These include air, space, cyber, land, sea, multi-domain, and advanced weapons. Although its primary client is the United States, it also has global operations in focus countries like Japan, Australia, South Korea, and the Middle East. Northrop Grumman manufactures some of the most cutting edge military vehicles in the world including the B-2 Spirit Stealth Bomber and the E-2D Advanced HawkeyeNorthrop Grumman Dividend History

The defense industry is a lucrative one and similar to rivals like Boeing (NYSE:BA), Raytheon Technologies (NYSE:RTX), Lockheed Martin (NYSE:LMT) Currently, Northrop Grumman pays out an annualized dividend yield of 1.43% which pays out on a quarterly basis. The yield is lower than the average yield in the S&P 500 although the company has steadily raised the dividend over time. In 2021, Northrop Grumman returned an estimated $4.7 billion to shareholders through both dividends and share buybacks. Despite the challenging environment, the company raised its dividend by 8.0% which was the 18th consecutive annual dividend increase. Oftentimes it is this strength that is more important to a dividend than the yield itself.

Currently, Northrop Grumman pays out an annualized dividend yield of 1.43% which pays out on a quarterly basis. The yield is lower than the average yield in the S&P 500 although the company has steadily raised the dividend over time. In 2021, Northrop Grumman returned an estimated $4.7 billion to shareholders through both dividends and share buybacks. Despite the challenging environment, the company raised its dividend by 8.0% which was the 18th consecutive annual dividend increase. Oftentimes it is this strength that is more important to a dividend than the yield itself.

Is Northrop Grumman a Good Investment?

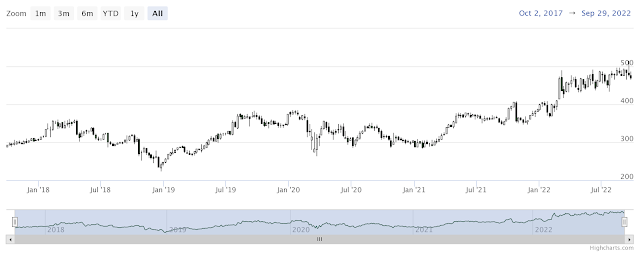

Given the recent market volatility, defense stocks have held up as one of the strongest recession-proof industries. So far in 2022, NOC stock has returned 25.46% and 33.26% over the past twelve months. This has far outperformed the S&P 500 and Dow Jones IndexComments

Northrop Grumman Company Profile

This topic: Sandbox > NorthropGrummanCompanyProfile

Topic revision: r1 - 2022-09-30 - AbdulAlim

Ideas, requests, problems regarding TWiki? Send feedback